RiskPal and Hotspot Cover Travel Insurance

RiskPal has teamed up with Hotspot Cover to offer travellers affordable and easily accessible travel insurance cover for trips to high risk and hostile territorial regions.

We spoke to Mark Butler, Director at Hotspot Cover to find out a bit more about the company, its goals and what the impact the pandemic has had on the insurance sector.

RiskPal: Mark, can you tell us a bit about the driving ideas behind launching Hotspot?

Mark: Hotspot Cover is a specialist travel insurance for people going to “hotspots” (hence the name). We have an online quote and bind capability, and service global customers traveling anywhere in the world, including conflict zones.

Typically, it’s extremely difficult, time-consuming and expensive to get this type of cover through the traditional routes – such as going through a Lloyd’s of London. Essentially, we are trying to commoditise a fragmented insurance landscape for high hazard travel, and remove its associated administrative burden while providing the right level of cover and protection for all customers.

RiskPal: How much has the insurance market changed during the pandemic and what do you think will be the lasting effects of these changes?

Mark: Customers are aware of exclusions more now than ever before, having either been on the end of a claim being rejected or reading about it in the media. This means customers are more inclined to know what they’re looking for when going into the buying process, and more likely to read the fine print a little more carefully.

We therefore believe the quote process and policy documents MUST be easily understood, as well as being fully transparent, otherwise it will leave customers remaining ill-informed and confused.

We’re also seeing customers and businesses seek out suitable travel insurance products more as they want to be properly covered and protected – when in the past they may have simply “taken the risk” and, possibly, regretted if afterwards.

As to the overall insurance market, the pandemic has forced through a number of changes including reduced underwriting capacity and increased rates for those products that are still available. It has also slowed innovation across large sectors of the market.

RiskPal: What have been the biggest challenges for Hotspot Cover operating and launching during this difficult time?

Mark: Initially, it was clearly ensuring that all of our policies continued to give coverage for COVID-19. As you can imagine continuing to offer coverage, including for COVID-19 just after a global pandemic was declared, was not a given, and it was a very unfortunate to say the least that our official launch coincided almost to the day with the first lockdown in the UK! The insurance market was naturally a little edgy and trying to assess the likely impact of the pandemic on all travel insurance risk.

We persevered, reviewed the reinsurance market carefully and managed to secure and maintain reinsurance capacity to support Hotspot Cover. That enabled us to launch with full cover for COVID-19. We believe we were one of the first to offer this globally.

Travel is starting to pick up again as the world starts to reopen and we remain very positive that we’ll continue to support travel to remote destinations.

RiskPal: What plans do you have for the company in the next 12 months?

Mark: We’re investing further into our technology over the next year, with some exciting new tools coming out very soon. For the frequent travellers or organisations doing multiple trips per year, we’ll be offering annual policies. We’re also about to launch our smartphone app with a ‘red button’ safety alert function. You’ll be able to manage your policies from within the app as well.

We know that responding on the ground in real time to physical injury is a priority, but sadly people can carry some of their injuries (physical and psychological) home with them. Just look at the devastating impact of trauma that continues to impair the everyday lives of the 2015 Paris terror attack victims, as reported widely in recent court proceedings. We are working closely with partners in this area, MBL, to offer a trauma counselling service as a key part of a company’s duty of care.

RiskPal: Why did you want to work with RiskPal and what do you like about the platform?

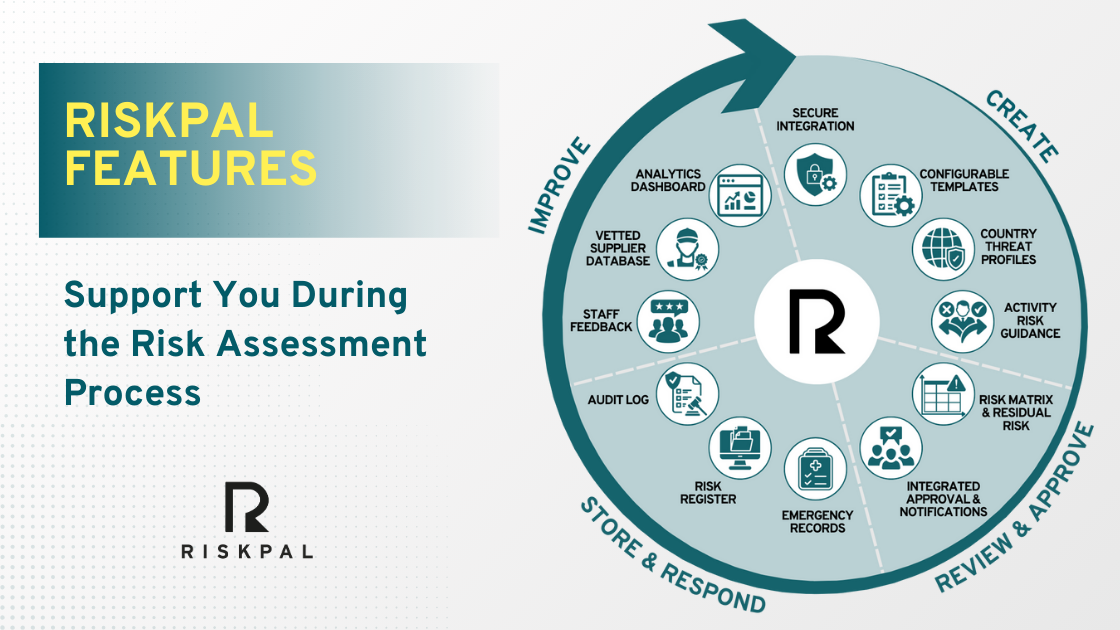

Mark: Safety and preparation is super important to us at Hotspot Cover. We spend a lot of time working with our network and partners to make sure we have the most up to date information and trends available to our customers as to what is going on in all hotspots around the world. RiskPal share a similar ethos in this regard and the team are an integral part of our network. Their knowledge in specific areas such as risk assessment and ISO 31030 will be essential to us as we extend risk management knowledge to our customers.

The RiskPal platform has put the user experience at the forefront of the design, mirroring what we are doing at Hotspot Cover. As an insurer, risk assessment is vital and something that complements our offering to many of our customers, particularly, the larger ones.

Contact Us to find out more about RiskPal.